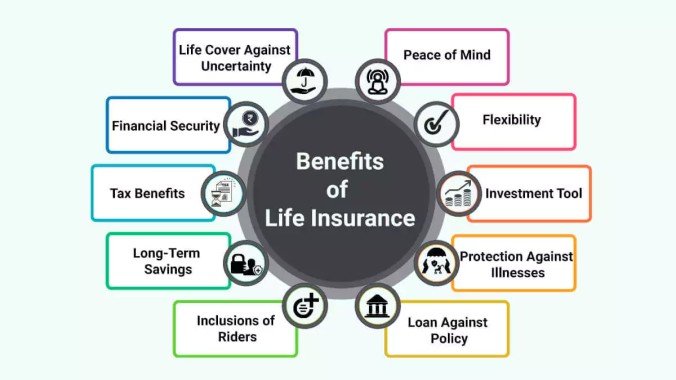

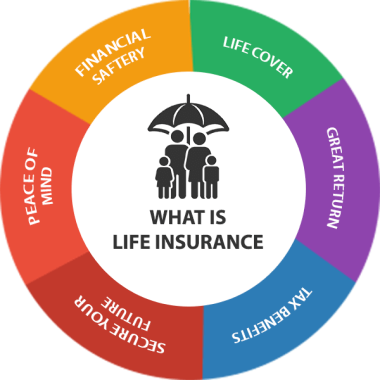

Life is unpredictable — insurance ensures your family, assets, and future are always secure. At [Your Company Name], we provide tailored insurance plans across life, health, general, and business categories to give you peace of mind and financial protection when you need it most.

Insurance is not just a safety net; it's a smart financial tool that reduces risk, supports long-term planning, and secures loved ones in case of life’s uncertainties. Whether you're safeguarding your health, your income, or your property — we help you choose the right coverage for every stage of life.

Types of Insurance We Offer

🧍Life Insurance

Ensure your family’s financial security even in your absence — choose from Term, Endowment, ULIP, and Whole Life plans.

💉 Health Insurance

Cover hospitalization, surgeries, and critical illnesses with individual, family floater, and senior citizen policies.

🚗 Motor Insurance

Get vehicle protection for cars, bikes, and commercial vehicles — including third-party liability and own-damage cover.

🏠 Home Insurance

Safeguard your property against fire, theft, natural calamities, and more.

🧳 Travel Insurance

Travel stress-free with global coverage for medical emergencies, cancellations, and baggage loss.

🏢 Business & Corporate Insurance

Protect your enterprise with professional indemnity, liability, group health, and fire insurance solutions.

- Expert Guidance to Choose the Right Plan

- Simple Documentation & Digital Onboarding

- Renewals, Claims & Servicing Support

- Customized Plans for Individuals & Corporates

- Real-Time Assistance & App Tracking

- Tax Benefits Under Sections 80C & 80D

- Free Insurance Need Analysis & Quotes

We offer personalized consultations to assess your needs and recommend the best policy from top insurers.

Yes, we provide side-by-side comparisons of features, premiums, and benefits across providers.

Our dedicated claims team ensures quick and smooth processing, helping you every step of the way.

Yes, life and health insurance premiums are eligible for deductions under Sections 80C & 80D of the Income Tax Act.