Looking to build long-term wealth or meet short-term financial goals? Mutual funds offer a flexible, professionally managed way to invest in equities, debt, or hybrid assets — tailored to your risk appetite and financial ambitions.

Whether you're a first-time investor or a seasoned planner, our wide range of mutual fund options helps you diversify your portfolio and optimize returns.

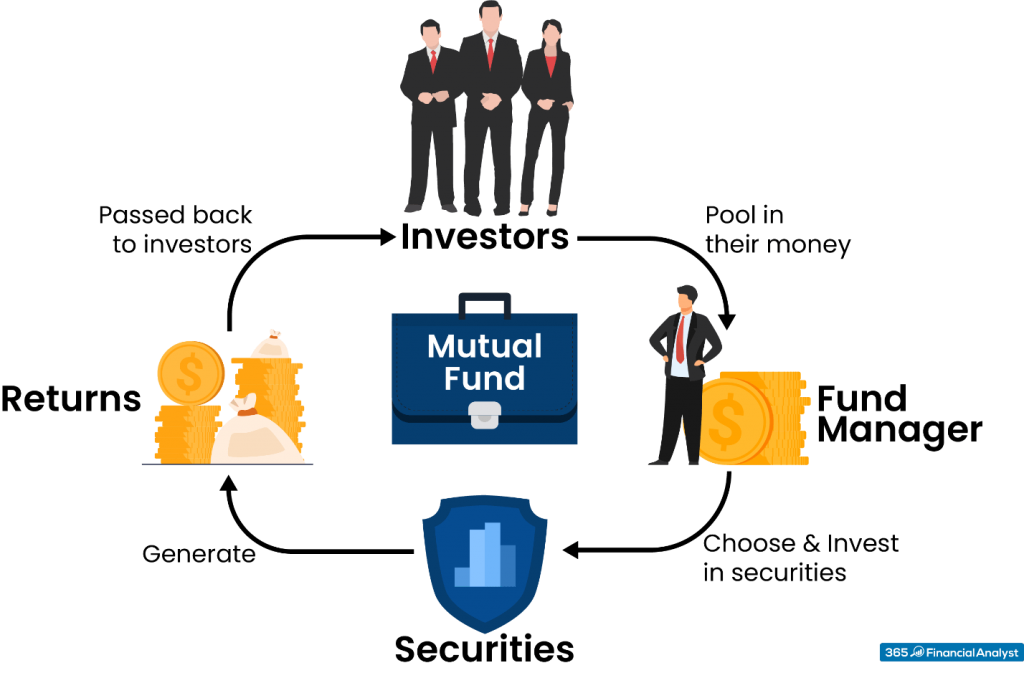

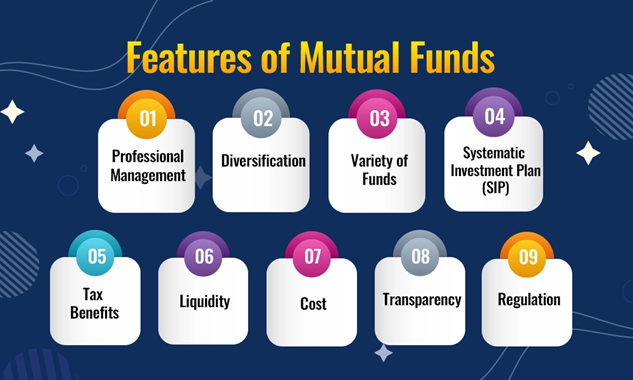

Mutual funds pool money from investors and are managed by experienced fund managers who make strategic investments across different sectors. They’re ideal for those seeking transparency, flexibility, and a smarter approach to wealth creation — with options ranging from low-risk debt funds to high-growth equity funds.

- Especially over the long term through equity exposure

- Invest across industries, asset classes, and geographies

- Professional oversight ensures better decision-making

- Choose SIPs, lump-sum, or goal-based investing

- ELSS funds offer tax deductions under Section 80C

- Start investing with as little as ₹500

- Easy to enter and exit most funds with minimal hassle

- Monitor performance through our online dashboard

- Access to Top AMC Partners (HDFC, ICICI, SBI, and more)

- Personalized advisory based on your risk profile

- Secure digital KYC and paperless onboarding

- Easy SIP setup & performance tracking through mobile

- Transparent fees & zero hidden charges

A mutual fund collects money from investors and invests it in stocks, bonds, or other securities to generate returns.

Equity funds, debt funds, hybrid funds, ELSS (tax-saving), liquid funds, and more.

Yes, except for funds with a lock-in period like ELSS. Others offer high liquidity.

They carry market risks but offer high transparency. Debt funds are lower risk; equity funds have higher growth potential.