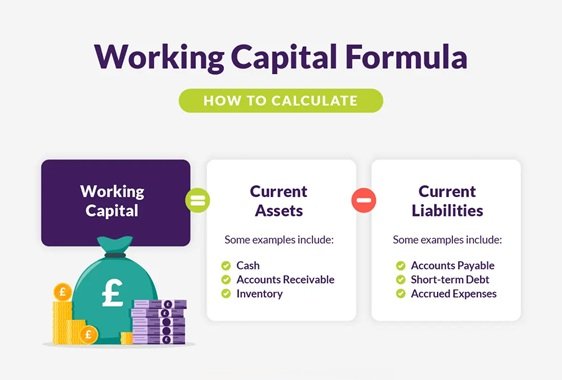

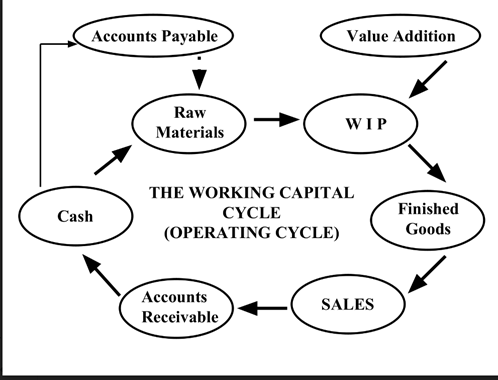

Running a business means managing cash flow, seizing opportunities, and overcoming short-term financial challenges. Our Working Capital Loans are designed to give your business the liquidity it needs to operate smoothly — whether it's restocking inventory, paying vendors, managing payroll, or funding growth.

From manufacturers to traders and service providers, businesses often face seasonal or situational cash crunches. A Working Capital Loan bridges that gap without disrupting your operations or long-term plans. With flexible terms, competitive interest rates, and minimal documentation, we help you stay in control.

- Fast approval and fund release to meet urgent needs

- Ideal for operational and day-to-day expenses

- Simplified documentation for faster processing

- Choose what suits your cash cycle

- Get the best offer through multiple banking partners

- Continue using as per your working capital cycle

- Unsecured loans available for eligible businesses

- Tailored repayment to suit business inflows

Businesses with a stable income, valid business registration, and basic financial documents can apply.

To fund short-term expenses like inventory, salaries, rent, and day-to-day operations.

Not always. We offer both secured and unsecured working capital loan options depending on your profile.

Loan approvals can be as fast as 48–72 hours with complete documentation.